Dutch Defence Minister Ruben Brekelmans has said his country is sending 300 troops and Patriot air defence missile systems to Poland to “defend NATO territory, protect supply to Ukraine, and deter Russian aggression”.

Dutch Defence Minister Ruben Brekelmans has said his country is sending 300 troops and Patriot air defence missile systems to Poland to “defend NATO territory, protect supply to Ukraine, and deter Russian aggression”.

The Netherlands’ announcement on Wednesday came as Polish officials said that an object that fell in a cornfield in Poland’s east on Tuesday night may have been a Russian version of the Shahed drone.

The explosion from the drone broke windows in several houses in the village of Osiny, near Poland’s border with Ukraine, but no injuries were reported, according to an official cited by Poland’s state news agency PAP.

Brekelmans told Dutch public broadcaster NOS on Wednesday that the military support to Poland came alongside other countries providing similar assistance to the NATO-member country, which borders Ukraine.

International Glance

International Glance Australia lashes Israeli leader Benjamin Netanyahu after he said the country’s prime minister was weak, with a top minister saying strength is more than “how many people you can blow up.”

Australia lashes Israeli leader Benjamin Netanyahu after he said the country’s prime minister was weak, with a top minister saying strength is more than “how many people you can blow up.” Germany will suspend arms exports to Israel that could be used in the Gaza Strip, Chancellor Friedrich Merz announced Friday, marking Berlin’s clearest shift yet in response to Israel’s escalating military campaign.

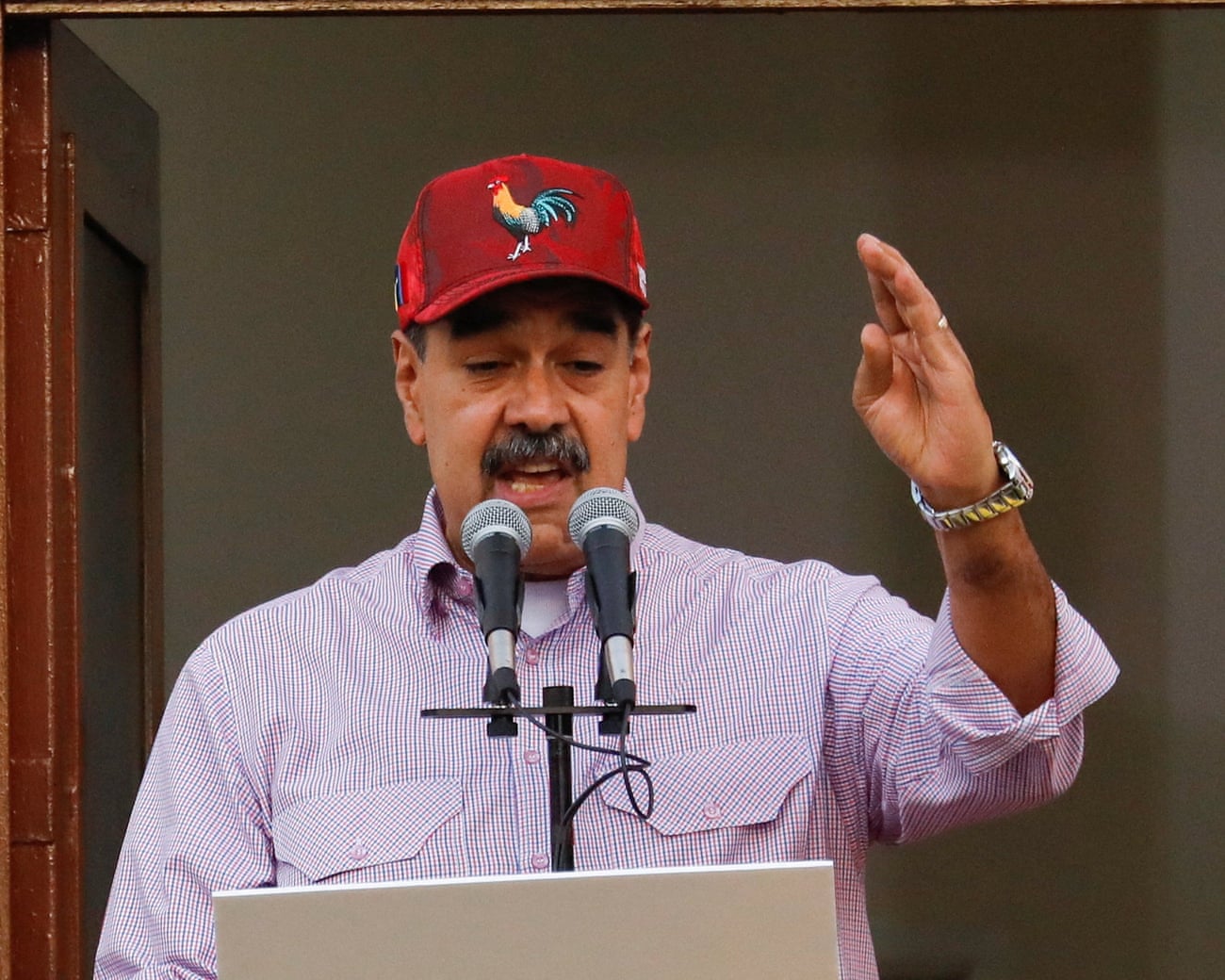

Germany will suspend arms exports to Israel that could be used in the Gaza Strip, Chancellor Friedrich Merz announced Friday, marking Berlin’s clearest shift yet in response to Israel’s escalating military campaign. The Trump administration is doubling to $50m a reward for the arrest of Venezuela’s president, Nicolás Maduro, accusing him of being one of the world’s largest narcotraffickers and working with cartels to flood the US with fentanyl-laced cocaine.

The Trump administration is doubling to $50m a reward for the arrest of Venezuela’s president, Nicolás Maduro, accusing him of being one of the world’s largest narcotraffickers and working with cartels to flood the US with fentanyl-laced cocaine. Israeli authorities are moving forward with plans to dramatically expand illegal settlements in the occupied West Bank, despite growing international condemnation and warnings that the move would destroy already moribund prospects for a two-state solution.

Israeli authorities are moving forward with plans to dramatically expand illegal settlements in the occupied West Bank, despite growing international condemnation and warnings that the move would destroy already moribund prospects for a two-state solution. Secretary of State Marco Rubio said Wednesday that U.S. envoy Steve Witkoff will return from Moscow with a framework for peace between Russia and Ukraine.

Secretary of State Marco Rubio said Wednesday that U.S. envoy Steve Witkoff will return from Moscow with a framework for peace between Russia and Ukraine.