Former Countrywide chief Angelo Mozilo agreed to a settlement of $67.5 million to resolve charges that he duped the home loan company's investors while reaping a personal windfall, but Bank of America will pick up two-thirds of the bill.

Former Countrywide chief Angelo Mozilo agreed to a settlement of $67.5 million to resolve charges that he duped the home loan company's investors while reaping a personal windfall, but Bank of America will pick up two-thirds of the bill.

Mozilo, poster boy of the subprime mortgage market's boom and bust, reached a last-minute deal with the U.S. Securities and Exchange Commission before his trial on civil fraud charges was to start on Tuesday.

Mozilo settles Countrywide fraud case at $67.5 million

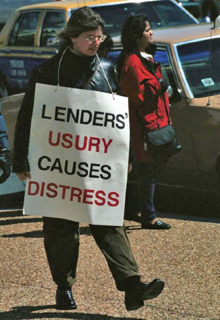

Interest - Our Invisible Slavery

Let's say you want to buy a house and go the bank and get a loan. Say 200k. The simple truth is, after thirty years you will have payed back 600k. 200k for the principal and 400k (!!) in interest.

Let's say you want to buy a house and go the bank and get a loan. Say 200k. The simple truth is, after thirty years you will have payed back 600k. 200k for the principal and 400k (!!) in interest.

Now this might be ok, or at least somewhat understandable, if you were borrowing this money from somebody else, who has been saving it. But as we know, this is not the case. The money is produced the moment the loan is granted by the bank. In a computer program. By pressing a few buttons.

So basically you pay 400k interest for pressing a button. Granted, the bank needs to manage the loan during the time it is being repaid. But the cost for this is still only a fraction of the income they get through the interest.

50 state attorneys general announce foreclosure probe

The attorneys general of all 50 U.S. states announced Wednesday that they are joining to probe mortgage loan servicers who are accused of submitting false affidavits, but they stopped short of calling for a national moratorium.

The attorneys general of all 50 U.S. states announced Wednesday that they are joining to probe mortgage loan servicers who are accused of submitting false affidavits, but they stopped short of calling for a national moratorium.

The multistate investigation will initially focus on whether Bank of America, J.P. Morgan Chase, Ally Financial and other large mortgage companies made misleading or fraudulent statements to evict struggling borrowers from their homes.

Film studio MGM bankruptcy plan announced

Hollywood film studio Metro Goldwyn Mayer has begun plans to file for bankruptcy protection in an effort to rid itself of $4bn (£2.5bn) of debts. The studio is asking more than 100 of its creditors to approve a plan that will see it enter chapter 11 bankruptcy while it restructures.

Hollywood film studio Metro Goldwyn Mayer has begun plans to file for bankruptcy protection in an effort to rid itself of $4bn (£2.5bn) of debts. The studio is asking more than 100 of its creditors to approve a plan that will see it enter chapter 11 bankruptcy while it restructures.

Creditors will get a 95% stake in the company as part of the deal. MGM said it would continue to operate as normal during the bankruptcy procedures.

Buffett says cut taxes for all but the rich

Buffett, the billionaire investor who runs Berkshire Hathaway (BRKA), said Tuesday at Fortune's Most Powerful Women Summit in Washington that the nation's tax code "has gotten distorted to a huge extent," by levying higher taxes on secretaries and janitors than on CEOs and private equity whiners.

Buffett, the billionaire investor who runs Berkshire Hathaway (BRKA), said Tuesday at Fortune's Most Powerful Women Summit in Washington that the nation's tax code "has gotten distorted to a huge extent," by levying higher taxes on secretaries and janitors than on CEOs and private equity whiners.

Growth of California's pot industry is good news for unions

In a suburban oasis amid golden hills north of San Francisco, members of the United Food and Commercial Workers union are processing thousands of marijuana cigarettes a day, rolling joints in rice paper cylinders from Amsterdam.

In a suburban oasis amid golden hills north of San Francisco, members of the United Food and Commercial Workers union are processing thousands of marijuana cigarettes a day, rolling joints in rice paper cylinders from Amsterdam.

The startup factory for a Bay Area firm called Medi-Cone is part of a commercial industry evolving to serve the hundreds of thousands of medical pot users who can legally use the drug in California, as well as marijuana dispensaries amassing an estimated $1.3 billion in annual transactions.

Robert Reich: Income gap leading to 'dead' economy

Economists and historians will study the so-called Great Recession for decades to come, but we already know that the deep downturn laid bare the widening income gap between rich and poor in America.

Economists and historians will study the so-called Great Recession for decades to come, but we already know that the deep downturn laid bare the widening income gap between rich and poor in America.

The Census Bureau reported on Sept. 16 that the number of Americans living in poverty hit a 51-year high in 2009, and income disparity has only grown more severe in economic hard times. It's led Robert Reich to conclude the time is now for tough medicine to narrow this gulf.

More Articles...

Page 36 of 70

Economic Glance

Economic Glance