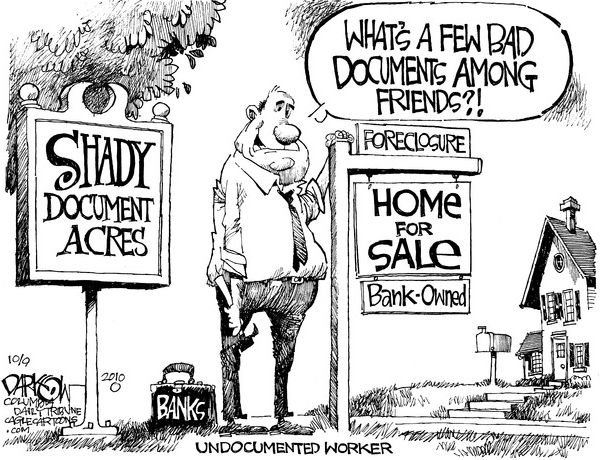

Banks repossessed a record one million US homes in 2010, and could surpass that number this year, figures show. Foreclosure tracker RealtyTrac said about five million homeowners were at least two months behind on their mortgage payments.

Banks repossessed a record one million US homes in 2010, and could surpass that number this year, figures show. Foreclosure tracker RealtyTrac said about five million homeowners were at least two months behind on their mortgage payments.

Foreclosures are likely to remain numerous while unemployment remains stubbornly high, the group said. Among the worst hit states were Nevada, Arizona, Florida and California, once at the heart of the housing boom.

US banks 'foreclosed on record 1m homes in 2010'

THE FED HAS SPOKEN: NO BAILOUT FOR MAIN STREET

The Federal Reserve was set up by bankers for bankers, and it has served them well. Out of the blue, it came up with $12.3 trillion in nearly interest-free credit to bail the banks out of a credit crunch they created. That same credit crisis has plunged state and local governments into insolvency, but the Fed has now delivered its ultimatum: there will be no “quantitative easing” for municipal governments.

The Federal Reserve was set up by bankers for bankers, and it has served them well. Out of the blue, it came up with $12.3 trillion in nearly interest-free credit to bail the banks out of a credit crunch they created. That same credit crisis has plunged state and local governments into insolvency, but the Fed has now delivered its ultimatum: there will be no “quantitative easing” for municipal governments.

On January 7, according to the Wall Street Journal, Federal Reserve Chairman Ben Bernanke announced that the Fed had ruled out a central bank bailout of state and local governments. "We have no expectation or intention to get involved in state and local finance," he said in testimony before the Senate Budget Committee. The states "should not expect loans from the Fed."

Fed prints another $600bn to keep US recovery on track

The dollar fell against most currencies due to QE, raising fears of a retaliatotry strike by the Bank of Japan on Friday.

The dollar fell against most currencies due to QE, raising fears of a retaliatotry strike by the Bank of Japan on Friday.

The Fed's decision will also heap pressure on the Bank of England to follow suit on Thursday, when it decides whether to increase its £200bn of QE.

War for the People; Profit for the Bankers

The Federal Reserve was set up in 1913 to finance both sides of two subsequent world wars. In other words, these wars were funded by the credit of the US taxpayer. Apart from profiting from it , the Illuminati bankers use war to enslave us with debt, enact social change and consolidate their power.

The Federal Reserve was set up in 1913 to finance both sides of two subsequent world wars. In other words, these wars were funded by the credit of the US taxpayer. Apart from profiting from it , the Illuminati bankers use war to enslave us with debt, enact social change and consolidate their power.

The Federal Reserve has helped underwrite continued American military expenditures, even after the World Wars. As of 2009, "Defense" accounts for 23% of all American Federal spending. And therefore, the gargantuan size of the American Federal debt is related to the continuation of American military interventions abroad.

Obama Created More Jobs In One Year Than Bush Created In Eight

This morning, the Labor Department released its employment data for December, showing that the U.S. economy ended the year by adding 113,000 private sector jobs, knocking the unemployment rate down sharply from 9.8 percent to 9.4 percent — its lowest rate since July 2009. The “surprising drop — which was far better than the modest step-down economists had forecast — was the steepest one-month fall since 1998.” October and November’s jobs numbers were also revised upward by almost 80,000 each. Still, 14.5 million Americans remain unemployed, and jobs will have to be created much faster in coming months for the country to pull itself out of the economic doldrums.

This morning, the Labor Department released its employment data for December, showing that the U.S. economy ended the year by adding 113,000 private sector jobs, knocking the unemployment rate down sharply from 9.8 percent to 9.4 percent — its lowest rate since July 2009. The “surprising drop — which was far better than the modest step-down economists had forecast — was the steepest one-month fall since 1998.” October and November’s jobs numbers were also revised upward by almost 80,000 each. Still, 14.5 million Americans remain unemployed, and jobs will have to be created much faster in coming months for the country to pull itself out of the economic doldrums.

Federal Reserve works to strip a key mortgage protection for homeowners - Rescission

As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys. They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

Former Obama Auto Industry Czar Steven Rattner Will Pay $10 Million in Restitution

Steven Rattner, the former principal of private equity firm Quadrangle Group LLC, will pay $10 million to settle a probe by New York Attorney General Andrew Cuomo of corruption at the state pension fund in a deal that largely ends a three-year investigation that has yielded eight guilty pleas.

Rattner's payment of restitution to the state of New York is less than half of the $26 million Cuomo sought. Rattner also agreed to be banned from appearing in any capacity before any public pension fund in the state for five years, the attorney general’s office said in an e-mailed statement. Cuomo, New York's governor -elect, sought a lifetime ban from the securities industry.

More Articles...

Page 33 of 70

Economic Glance

Economic Glance