A $70m lawsuit filed by Dan Rather, the veteran former newsreader for CBS Evening News, against his old network is reopening the debate over alleged favourable treatment that Bush received when he served in the Texas Air National Guard during the Vietnam war. Bush had hoped that this controversy had been dealt with once and for all during the 2004 election.

What Is Left?

Who will weep for our lost Nation? How many citizens will cry in anguish for our republic, devastated and destroyed by an elite group of insiders who, bit by bit, through stealth, lies, deceit, chicanery, and outright criminal fraud have wrecked Constitutional havoc. Checks and balances are gone. Congress is bought and sold by corporate lobbyists. Congress no longer works for us. The judiciary, packed with neocons, then shoves new "legal interpretations" down our own throats or disregards time-honored ones. Our country is no longer "we, the people." Now, it is "we, the corporations." Is this not fascism?

Aided and abetted by a corporate-controlled media, American sheople have bought into the Electronic Age's Orwellian doublethink and doublespeak. It was all planned.

Coal Ash Spill Is Much Larger Than Initially Estimated

A coal ash spill that blanketed residential neighborhoods and contaminated nearby rivers in Roane County, Tenn., earlier this week is more than three times larger than initially estimated, the Tennessee Valley Authority said on Thursday.

Coal ash, a byproduct of burning coal, contains toxic heavy metals like arsenic, lead and selenium that can cause cancer and neurological problems.

Blindsided by crisis, economists rethink profession along with theories

But academic economists are. And with very few exceptions, they did not predict the crisis, either. Some warned of a housing bubble, but almost none foresaw the resulting cataclysm. An entire field of experts dedicated to studying the behavior of markets failed to anticipate what may prove to be the biggest economic collapse of our lifetime. And now that we are in the middle of it, many frankly admit that they are not sure how to prevent things from getting worse.

But academic economists are. And with very few exceptions, they did not predict the crisis, either. Some warned of a housing bubble, but almost none foresaw the resulting cataclysm. An entire field of experts dedicated to studying the behavior of markets failed to anticipate what may prove to be the biggest economic collapse of our lifetime. And now that we are in the middle of it, many frankly admit that they are not sure how to prevent things from getting worse.

Study Criticizes Bush Approach to War Funding, Calls for Changes

President-elect Barack Obama's administration needs to monitor war spending much more closely than the current White House has, according to a new study that criticizes President Bush's approach to funding the Iraq and Afghanistan wars -- a bill that is projected to approach nearly $1 trillion next year.

Even with declining troop numbers in Iraq, the direct price tag of the two wars could grow as high as $1.7 trillion by 2018, the Center for Strategic and Budgetary Assessments reported last week. The defense think tank's figure does not include potentially hundreds of billions more in indirect economic and social costs, such as higher oil prices and lost wages.

The war in Iraq alone has already cost more in inflation-adjusted dollars than every other U.S. war except World War II, the CSBA found.

TVNL Comment: The war was started in order to loot this nation. The same people that privatized much of the military also profit from the private military complex of corporations. They weakened the military and made them dependent on private companies. Then they started the wars. It was always about the money for some of them.

Bush's $1 Trillion War on Terror: Even Costlier Than Expected

The news that President Bush's war on terror will soon have cost the U.S. taxpayer $1 trillion - and counting - is unlikely to spread much Christmas cheer in these tough economic times. A trio of recent reports - none by the Bush Administration - suggests that sometime early in the Obama presidency, spending on the wars started since 9/11 will pass the trillion-dollar mark. Even after adjusting for inflation, that's four times more than America spent fighting World War I, and more than 10 times the cost of 1991's Persian Gulf War (90 percent of which was paid for by U.S. allies). The war on terror looks set to surpass the cost the Korean and Vietnam wars combined, to be topped only by World War II's price tag of $3.5 trillion.

The news that President Bush's war on terror will soon have cost the U.S. taxpayer $1 trillion - and counting - is unlikely to spread much Christmas cheer in these tough economic times. A trio of recent reports - none by the Bush Administration - suggests that sometime early in the Obama presidency, spending on the wars started since 9/11 will pass the trillion-dollar mark. Even after adjusting for inflation, that's four times more than America spent fighting World War I, and more than 10 times the cost of 1991's Persian Gulf War (90 percent of which was paid for by U.S. allies). The war on terror looks set to surpass the cost the Korean and Vietnam wars combined, to be topped only by World War II's price tag of $3.5 trillion.

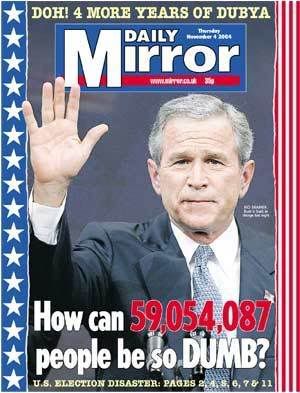

What if George Bush Was Not Elected in 2000 and 2004?

Maybe 59 million Americans were not dumb enough to elect George W. Bush as their president in the 2000 and the 2004 elections. Maybe the exit polls were correct after all and the vote results were not.

Maybe 59 million Americans were not dumb enough to elect George W. Bush as their president in the 2000 and the 2004 elections. Maybe the exit polls were correct after all and the vote results were not.Unfortunately, the only person who may have been able to verify that the voting machines in major states were rigged, Michael Connell, is now dead due to a mysterious airplane "accident".

States Cut Medicaid Coverage Further

States from Rhode Island to California are being forced to curtail Medicaid, the government health insurance program for the poor, as they struggle to cope with the deteriorating economy.

With revenue falling at the same time that more people are losing their jobs and private health coverage, states already have pared their programs and many are looking at deeper cuts for the coming year. Already, 19 states -- including Maryland and Virginia -- and the District of Columbia have lowered payments to hospitals and nursing homes, eliminated coverage for some treatments, and forced some recipients out of the insurance program completely.

Massive coal-ash spill causes river of sludge and controversy

What may be the nation's largest spill of coal ash lay thick and largely untouched over hundreds of acres of land and waterways Wednesday after a dam broke this week, as officials and environmentalists argued over its potential toxicity.

What may be the nation's largest spill of coal ash lay thick and largely untouched over hundreds of acres of land and waterways Wednesday after a dam broke this week, as officials and environmentalists argued over its potential toxicity.

Federal studies long have shown coal ash to contain significant quantities of heavy metals such as arsenic, lead and selenium, which can cause cancer and neurological problems. But with no official word on the dangers of the sludge in Tennessee, displaced residents spent Christmas Eve worried about their health and their property and wondering what to do.

The spill reignited a debate over whether the federal government should regulate coal ash as a hazardous material. Similar ponds and mounds of ash exist at hundreds of coal plants nationwide.

Page 1032 of 1175