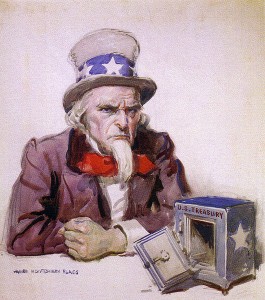

At least some of the billions of dollars that JPMorgan Chase lost gambling on credit derivatives once belonged to you.

At least some of the billions of dollars that JPMorgan Chase lost gambling on credit derivatives once belonged to you.

Outraged by Merkley’s impunity, Dimon roared that his bank only took the government’s lousy bailout money and only borrowed at rock-bottom interest rates from the Federal Reserve because the government insisted that it do so, for the sake of appearances and the good of the country. And JPMorgan is the country’s greatest hero, so it had no choice but to accept all of this free money the government was handing out. It certainly did not need it.

Economic Glance

Economic Glance Nokia plans to cut one in five jobs at its global cellphone business as it loses market share to rivals Apple and Samsung and burns through cash, raising new fears over its future.

Nokia plans to cut one in five jobs at its global cellphone business as it loses market share to rivals Apple and Samsung and burns through cash, raising new fears over its future. For nearly a decade, Beth Jacobson lived inside the vast machinery of subprime mortgages that shook the nation’s economy.

For nearly a decade, Beth Jacobson lived inside the vast machinery of subprime mortgages that shook the nation’s economy.

Crime generates an estimated $2.1 trillion in global annual proceeds - or 3.6pc of the world's gross domestic product - and the problem may be growing, a senior United Nations official has said.

Crime generates an estimated $2.1 trillion in global annual proceeds - or 3.6pc of the world's gross domestic product - and the problem may be growing, a senior United Nations official has said. Our entire economy is now based on debt. We are told that we have to go into debt for everything.

Our entire economy is now based on debt. We are told that we have to go into debt for everything.

Daniel Suelo lives in caves in the canyonlands of Utah. He survives by harvesting wild foods and eating roadkill.

Daniel Suelo lives in caves in the canyonlands of Utah. He survives by harvesting wild foods and eating roadkill.