An obscure federal regulator of electricity markets has emerged as a tough cop on the beat, taking on Wall Street banks and big energy firms alike for market manipulation. That aggressive approach stands out when it’s compared with that of the regulator in charge of looking for manipulation in the oil and gasoline markets.

An obscure federal regulator of electricity markets has emerged as a tough cop on the beat, taking on Wall Street banks and big energy firms alike for market manipulation. That aggressive approach stands out when it’s compared with that of the regulator in charge of looking for manipulation in the oil and gasoline markets.

Whether manipulation accounts for volatile oil and gasoline prices in recent years is a hotly debated topic since prices began their steep climb in late 2005. Last year’s West Coast price spikes amid ample supplies added to the urgency in determining whether excessive financial speculation is driving price volatility.

In 2005, Congress gave new anti-manipulation powers to the Federal Energy Regulatory Commission, the federal regulator of electricity markets. In 2007, lawmakers extended them to the Federal Trade Commission, which protects consumers from the manipulation of gas and oil prices.

To the ire of industry critics and the senator who authored the legislation that gave the new powers to both agencies, only the FERC has used those powers aggressively.

“The whole reason we gave the FTC this authority is because we believe these kinds of things that were happening in energy markets were not isolated to one type of energy, but were being perpetrated in other areas, particularly with oil,” said Sen. Maria Cantwell, D-Wash. “The FERC is doing its job in unearthing these things, and the FTC just seems to be asleep at the switch.”

Donald Trump has vented his fury against a green energy deal between the British government and...

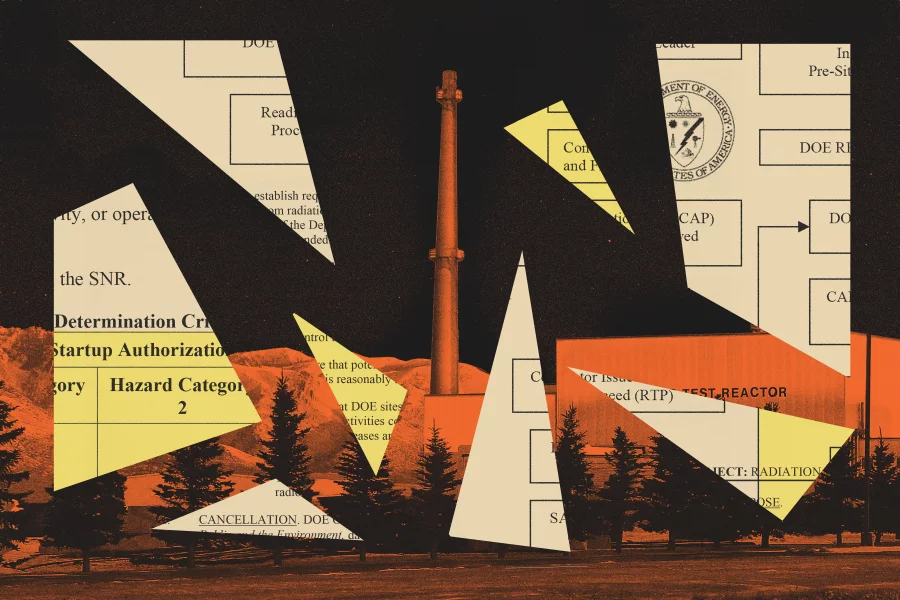

Donald Trump has vented his fury against a green energy deal between the British government and... The Trump administration has overhauled a set of nuclear safety directives and shared them with the...

The Trump administration has overhauled a set of nuclear safety directives and shared them with the... For those who did not manage to buy portable gas heaters and stoves, firebricks have become...

For those who did not manage to buy portable gas heaters and stoves, firebricks have become...