At least some of the billions of dollars that JPMorgan Chase lost gambling on credit derivatives once belonged to you.

At least some of the billions of dollars that JPMorgan Chase lost gambling on credit derivatives once belonged to you.

Outraged by Merkley’s impunity, Dimon roared that his bank only took the government’s lousy bailout money and only borrowed at rock-bottom interest rates from the Federal Reserve because the government insisted that it do so, for the sake of appearances and the good of the country. And JPMorgan is the country’s greatest hero, so it had no choice but to accept all of this free money the government was handing out. It certainly did not need it.

What Dimon did not say, however, was that JPMorgan Chase continues to get loads of free government money — probably $14 billion per year, according to number-crunching by Bloomberg, based on an International Monetary Fund study. Bloomberg’s editors write:

The money helps the bank pay big salaries and bonuses. More important, it distorts markets, fueling crises such as the recent subprime-lending disaster and the sovereign-debt debacle that is now threatening to destroy the euro and sink the global economy.

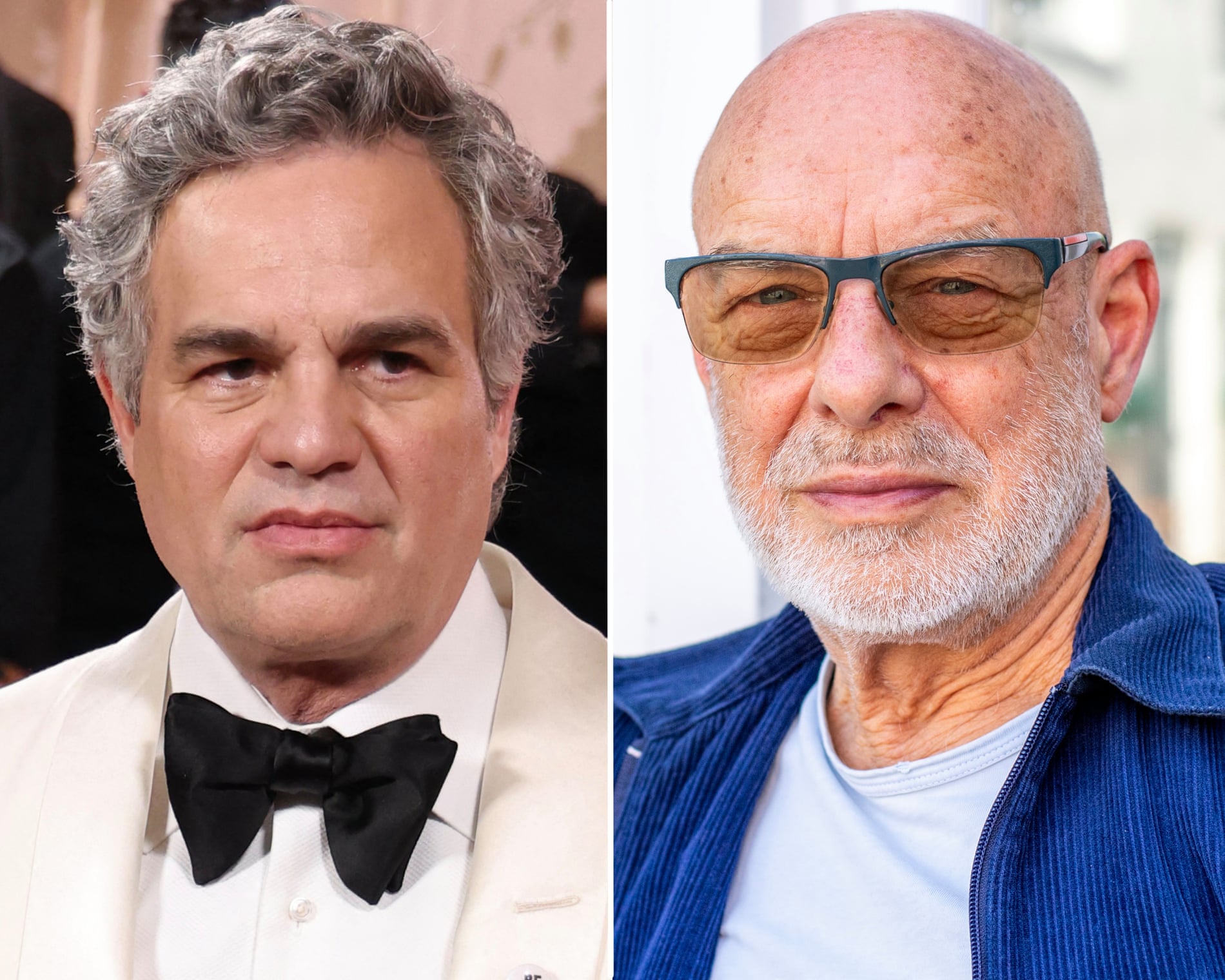

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes...

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...